The Impact Of Bankruptcy On Your Credit: Insights From Tulsa, Ok Bankruptcy Attorneys

The Impact Of Bankruptcy On Your Credit: Insights From Tulsa, Ok Bankruptcy Attorneys

Blog Article

Bankruptcy Lawyer Tulsa: Navigating Child Custody And Bankruptcy Issues

Table of ContentsTulsa, Ok Bankruptcy Attorney: Your Key To A Successful CaseTulsa Bankruptcy Lawyer: Understanding The Medical Bankruptcy ProcessTop 10 Tulsa Bankruptcy Attorneys: A Comprehensive GuideTulsa, Ok Bankruptcy Attorney: How To Handle Creditor Harassment During Bankruptcy

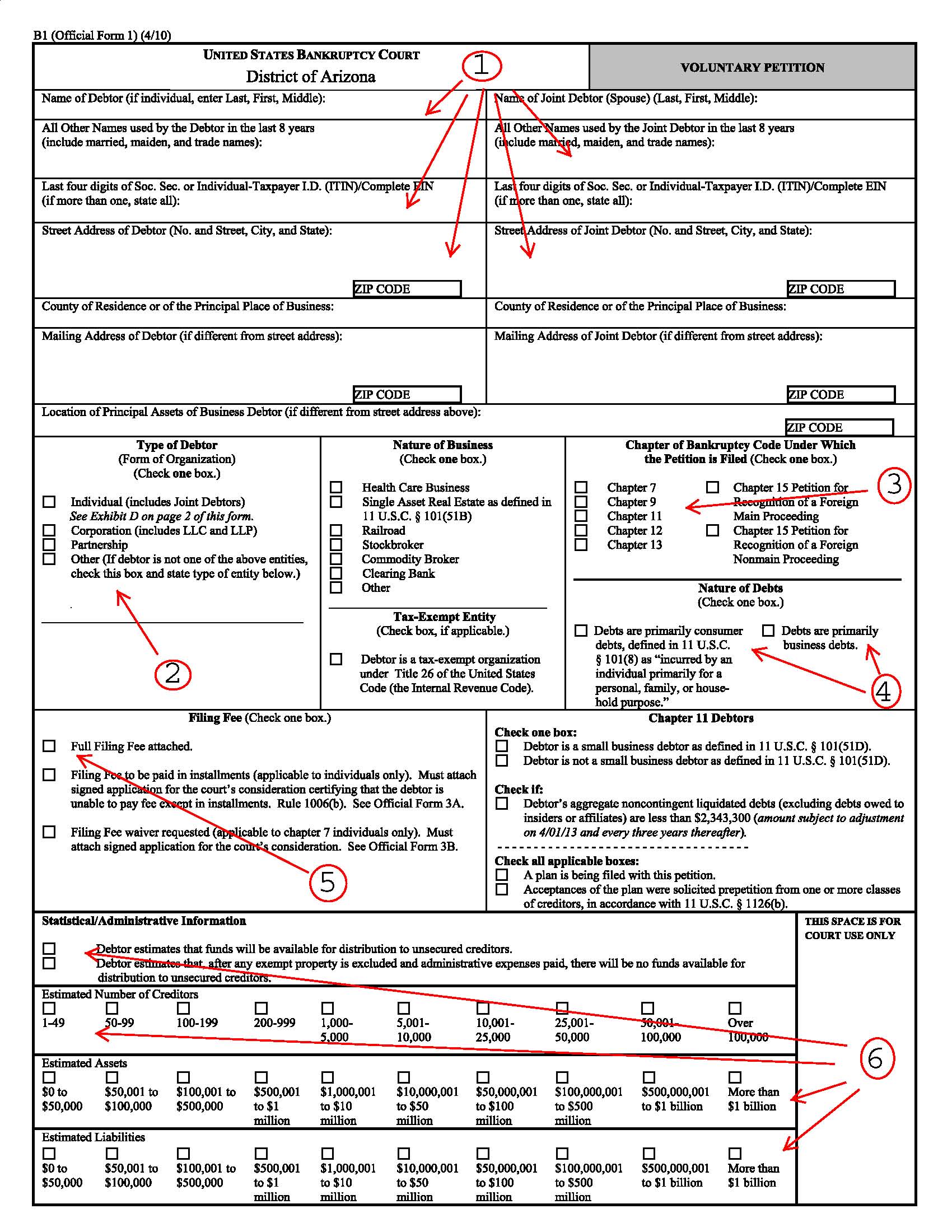

It can damage your credit report for anywhere from 7-10 years and be an obstacle toward obtaining security clearances. However, if you can't fix your issues in less than 5 years, insolvency is a sensible choice. Legal representative costs for personal bankruptcy vary relying on which form you choose, exactly how intricate your instance is and also where you are geographically. bankruptcy attorney Tulsa.Other personal bankruptcy prices include a filing charge ($338 for Phase 7; $313 for Chapter 13); and also costs for credit scores counseling as well as financial administration programs, which both expense from $10 to $100.

You do not constantly require an attorney when submitting private insolvency on your very own or "pro se," the term for representing on your own. If the case is straightforward sufficient, you can file for personal bankruptcy without aid.

The general rule is the less complex your bankruptcy, the far better your opportunities are of completing it on your own and also receiving an insolvency discharge, the order eliminating financial debt. Your case is most likely straightforward adequate to handle without an attorney if: However, also simple Phase 7 instances call for job. Strategy on submitting comprehensive documentation, gathering financial paperwork, looking into personal bankruptcy as well as exemption laws, as well as adhering to regional guidelines and treatments.

Tulsa, Ok Bankruptcy Attorney: Debunking Common Bankruptcy Misconceptions

Right here are 2 circumstances that constantly call for representation., you'll likely desire a legal representative.

If you make a blunder, the personal bankruptcy court might throw out your situation or offer possessions you believed you can maintain. If you lose, you'll be stuck paying the debt after personal bankruptcy.

If you make a blunder, the personal bankruptcy court might throw out your situation or offer possessions you believed you can maintain. If you lose, you'll be stuck paying the debt after personal bankruptcy. You might intend to file Phase 13 to catch up on home loan arrears so you can keep your house. Or you may desire to remove your bank loan, "stuff down" or decrease a vehicle loan, or pay back a financial obligation that won't go away in personal bankruptcy over time, such as back taxes or support arrears.

You might intend to file Phase 13 to catch up on home loan arrears so you can keep your house. Or you may desire to remove your bank loan, "stuff down" or decrease a vehicle loan, or pay back a financial obligation that won't go away in personal bankruptcy over time, such as back taxes or support arrears.Many individuals realize the lawful fees required to employ an insolvency lawyer are quite practical once they recognize just how they can gain from a personal bankruptcy attorney's assistance. In most cases, an insolvency lawyer can swiftly recognize problems you might not find. Some people documents for insolvency due to the fact that they do not recognize bankruptcy lawyer Tulsa their alternatives.

Tulsa, Ok Bankruptcy Attorney: The Role They Play In Your Financial Recovery

For many customers, the sensible choices are Phase 7 as well as Phase 13 bankruptcy. Each type has specific advantages that address certain troubles. If you desire to conserve your residence from repossession, Phase 13 may be your ideal bet. Chapter 7 could be the way to go if you have low income and no properties.

Staying clear of documents challenges can be problematic also if you select the right phase. Here are usual concerns insolvency lawyers can stop. Bankruptcy is form-driven. You'll have to complete a lengthy government package, as well as, in many cases, your court will certainly also have regional types. Lots of self-represented personal bankruptcy borrowers do not file all of the required insolvency documents, and also their instance obtains rejected.

If you stand to shed beneficial residential property like your house, cars and truck, or various other building you care around, an attorney could be well worth the money.

Not all bankruptcy cases continue smoothly, as well as other, extra difficult concerns can emerge. Many self-represented filers: do not understand the value of activities and also adversary actions can't adequately defend against an action seeking to refute discharge, and also have a hard time complying with complex insolvency procedures.

Bankruptcy 101: A Guide By Tulsa Bankruptcy Attorneys

Or another thing may appear. The bottom line is that a lawyer is crucial when you find on your own on the obtaining end of a movement or legal action. If you choose to declare personal bankruptcy on your very own, discover what solutions are available in your district for pro se filers.

Others can attach you with lawful aid organizations that do the very same. Many courts and also their sites have information for consumers declaring personal bankruptcy, from sales brochures defining low-cost or free solutions to in-depth Click This Link details regarding insolvency. Obtaining a great self-help book is also an outstanding concept. Look for an insolvency publication that highlights circumstances requiring an attorney.

You have to precisely fill in several kinds, research study the legislation, and participate in hearings. If you comprehend bankruptcy legislation however would certainly like help completing the types (the average bankruptcy application is around 50 web pages long), you might think about employing a personal bankruptcy petition preparer. A bankruptcy application preparer is anybody or service, other than an attorney or someone that works for an attorney, that bills a charge to prepare bankruptcy papers.

Since insolvency application preparers are not lawyers, they can not offer lawful recommendations or represent you in insolvency court. Specifically, they can't: tell you which kind of personal bankruptcy to submit tell you not to list particular financial obligations inform you not to note particular possessions, or inform you what residential property to exempt.

Since insolvency application preparers are not lawyers, they can not offer lawful recommendations or represent you in insolvency court. Specifically, they can't: tell you which kind of personal bankruptcy to submit tell you not to list particular financial obligations inform you not to note particular possessions, or inform you what residential property to exempt.Report this page